According to the AppsFlyer Performance Index 2024, global ad spend on app installs is projected to increase by 18%, compared to 2023. The driver of this growth? Non-gaming apps.

The category has seen a 23% YoY increase across verticals like e-commerce, entertainment, lifestyle, and utilities. And non-gaming apps are expected to continue their upward trajectory with SensorTower predicting 173 billion installs in 2024 and $145 billion in revenue by 2030.

But with so much competition in the market today, how can non-gaming apps stand out? Deciding where and how to allocate budgets can make all the difference in driving growth and maximizing ROI.

This blog explores best practice tips and strategies to help maximize returns for non-gaming apps, guiding you on how to focus your resources for the best results.

A Look at Where Your Ad Spend is Going

Mintegral data has uncovered the ad spend trends. Currently, the US and European markets are dominant when it comes to ad investment, with the majority of spend going on users in these countries. The US leads on iOS and ranks second on Android. That said, emerging markets are rapidly gaining traction. Let’s dive into the top markets for app advertising across key categories:

Mainstream Categories

- Lifestyle & Health/Fitness Apps: North America and Europe are prime markets most keen on integrating apps into their day-to-day health routines.

- Shopping Apps: Latin America is seeing a significant boom in e-commerce app marketing. But globally, the US remains on top.

- Finance Apps: Both India and Vietnam are seeing a surge in fintech adoption, particularly among younger demographics. Strong Android penetration and a large population of tech-savvy users in India make it a prime market for finance apps, giving rise to a competitive ad marketplace.

Emerging Categories

- Generative AI Apps: The early adopters—US, Germany, and France—are leading the charge in adopting generative AI apps. Furthermore, Generative AI apps are seeing exceptional ad performance, outperforming other non-gaming app categories in clicks and conversions.

- Mini-Series Apps: The US is the primary market for mini-series app developers due to high content consumption, and Southeast Asia is also a good entry market with lower user acquisition costs. To learn more about how to capitalize on this thriving market, you can check out Mintegral's latest guide on mini-series app here.

Now we know how each subcategory is shaping up in the global markets, it's time to capitalize. How can UA practitioners make the most of their marketing budgets?

UA Best Practice for Non-Gaming Apps

Market Like A Game Would

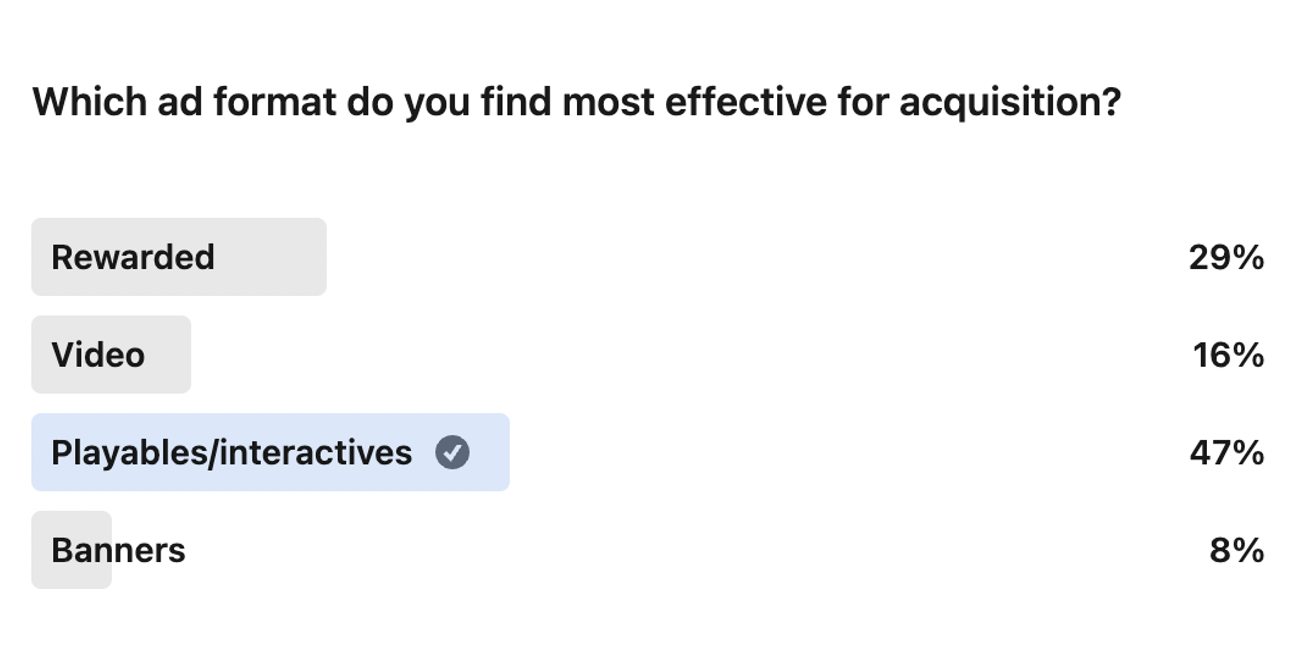

It's no secret that compelling creatives are crucial for capturing audience interest and driving conversions. But it's not just what people see, it's how they see it. Testing different formats like interactive ads (known as playables in the gaming space) could help boost your results. In fact, a quick poll revealed that 49% of marketers consider playables to be the most effective format for user acquisition.

In the past, playables were presumed to be costly to create. While static formats like banners or GIFs are easy and affordable, video ads, especially playables, require more investment, planning, and development.

For advertisers with limited in-house creative resources, Mintegral offers accessible solutions with tools like PlayTurbo. PlayTurbo provides templates that let you produce interactive ads at a low cost, and allows for quick experimentation with different creative types. For example, the English-learning app buddy.ai partnered with Mintegral and created interactive ads through PlayTurbo for several gaming platforms, achieving over 40 million downloads.

Consider Gaming App Inventory

While traditional advertising channels like Google, Meta, and TikTok remain popular choices for user acquisition, increasing competition on these platforms drives up Customer Acquisition Costs (CAC) as advertisers compete for limited inventory.

With over 3.3 billion people playing mobile games each month, gaming apps offer a unique opportunity to reach a broad and highly engaged audience. By advertising on gaming apps, developers can tap into a vast audience without facing the same high eCPM rates; instead, you can see a lower customer acquisition cost (CAC) while reaching the same or even larger audiences.

If you want to discover the key trends, opportunities, and strategies that non-gaming apps can take advantage of, check out our webinar here.

Alternative App Stores, Alternative Audiences

A new strategy for channel selection is crucial for efficient, high-growth scaling. Developers can break into untapped markets with third-party app stores a novel approach to finding new audiences.

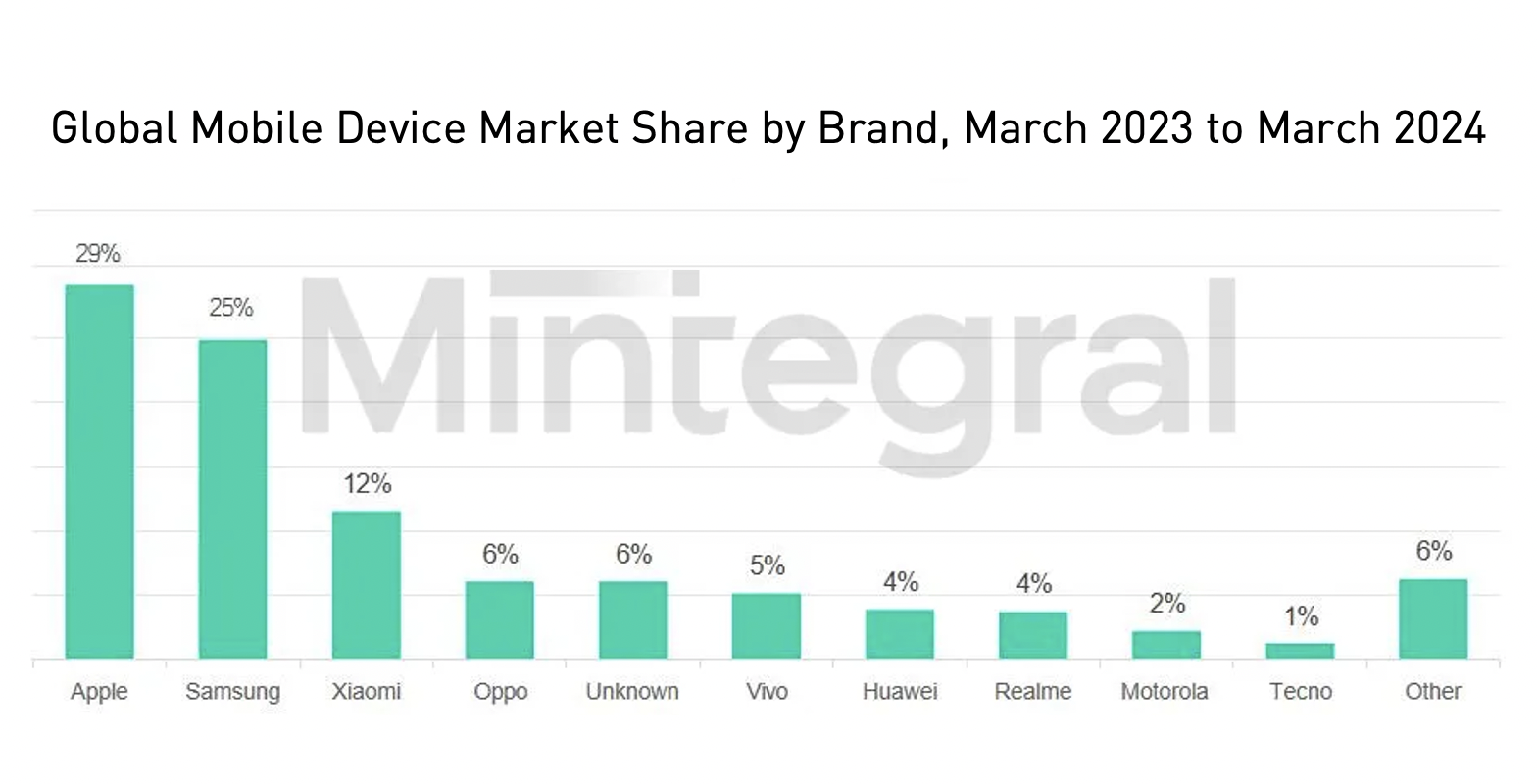

Diverse user demographics, support for pre-installations, and flexible app listing and promotion policies make third-party app stores potentially valuable and viable for app developers to acquire new users. Recent data shows Apple holds 29% of the global mobile app store market, followed by Samsung at 25%. Other Android app stores, such as Amazon Fire Tablets, OPPO, Vivo, and Xiaomi, have significant market penetration in Tier 1, 2, and 3 markets.

Further, there is a real benefit on cost saving. Alena Herasimchyk, Head of User Acquisition at SayGames, indicates that "compared to Google Play, Amazon Appstore’s bidding costs are often 20% lower. This helps us reduce acquisition costs and maximize ROI."

Let's take a look at some of the top third-party app stores to assess your options:

- Amazon Appstore: Available in over 200 countries, the Amazon Appstore has a strong presence in high-value markets like the US, UK, Germany, and France.

- Samsung Galaxy Store: With over 1 billion active users, the Samsung Galaxy Store is another major player in Tier 1 markets like the US, Europe, and South Korea.

- Xiaomi, OPPO, Vivo Stores: Together, these OEM stores reach over 500 million active users, primarily in Tier 3 regions, providing access to a vast user base in emerging markets.

- Huawei AppGallery: With approximately 580 million users, the Huawei AppGallery has a strong presence in Europe and APAC.

Mintegral supports ad placements and monetization for Amazon Appstore, Samsung Galaxy Store, and Xiaomi, OPPO, and Vivo stores. If you want to start a non-Google Play (GP) Android app store campaign, check out the Mintegral guide here.

Supercharge Non-Gaming UA with Mintegral

All non-gaming apps face the difficulty of competing with gaming app marketing that continues to evolve. To help you stay ahead of the game, Mintegral offers a suite of solutions — from creative customization to smart bidding solutions like Target CPE and Target ROAS.

For non-gaming apps focused on short-term ROI, Target ROAS helps acquire high-quality users at optimal costs. For apps targeting high-spending users, Target CPE is the ideal solution, enabling developers to precisely target users who are more likely to convert.

If you are not yet a Mintegral customer, sign up directly with us on our self-serve portal and get started with Mintegral AppGrowth today. If you have any questions or need support, feel free to visit the Mintegral Help Center to get the answers or reach out to us directly. Don’t forget to also follow us on LinkedIn and Facebook for the latest updates and insights!